Revenue contingency

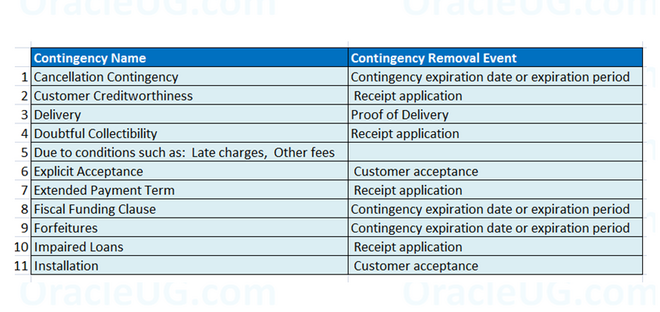

Receivables predefines a set of revenue contingencies that you can use with event-based revenue management. You cannot update or delete these predefined revenue contingencies, but you can create your own. Receivables also predefines contingency removal events, which you cannot delete or modify. A list of these predefined revenue contingencies, along with corresponding contingency removal events are shown in above pic.

For each contingency, you can define automatic defaulting rules to control which contingencies are assigned to which customer invoices.

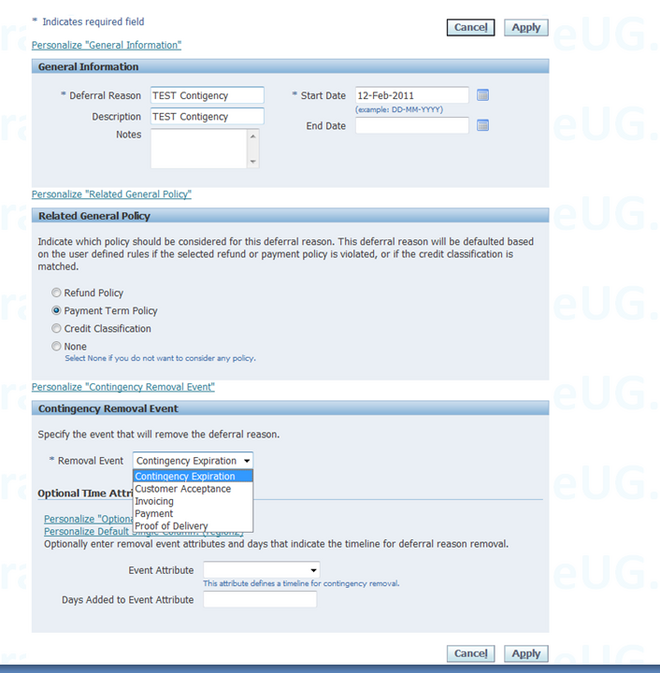

To define a revenue contingency:

1. Navigate to the Revenue Contingencies page.

2. Duplicate and then modify an existing contingency. Or, define a new contingency.

Tip: For easier contingency auditing, avoid modifying your user-defined contingencies. Instead, assign an end date to the existing contingency, and create a new contingency.

3. In the General Information region, enter basic details about the contingency, such as name, effective dates, and description.

Note: A contingency's last effective date controls only whether it can be defaulted to new order or invoice lines. An expired contingency on an order or invoice line remains valid, provided that it was valid on the day when originally defaulted.

4. In the Related General Policy region, select the revenue policy that Receivables will review when considering whether this contingency is applicable:

• Refund Policy

Receivables defaults this contingency if the invoice has a refund policy that violates your organization's standard policy.

• Payment Term Policy

Receivables defaults this contingency if the invoice has a payment term that violates your organization's standard policy.

• Credit Classification

Receivables defaults this contingency if the customer has a credit classification that matches one of the credit classifications defined in your organization's revenue policy.

• None

Receivables does not consider any details in your organization's revenue policy.

Note: Receivables reviews the above details in conjunction with any defaulting rules that you define.

5. In the Contingency Removal Event region, select the event that will remove the contingency from the invoice:

• Contingency Expiration

• Customer Acceptance

• Invoicing

• Payment

• Proof of Delivery

You can define multiple contingencies that have the same removal event.

6. Optionally enter removal event attributes and days that indicate the timeline for contingency removal. You can select these event attributes:

• Fulfillment Date

• Proof of Delivery Date

• Ship Confirm Date

• Transaction Date

Tip: If defining a pre-billing acceptance contingency whose removal event is Invoicing, do not select Transaction Date. This is because the order line will not be invoiced until after customer acceptance has been recorded in the feeder system.

For example, once 10 days have passed beyond an order's ship confirm date, you might want Receivables to automatically remove a customer acceptance contingency. (This is an example of implicit customer acceptance, as opposed to the

Explicit Customer Acceptance contingency that Receivables predefines.)

You can set this up as follows:

• Removal Event: Customer Acceptance

• Event Attribute: Ship Confirm Date

• Days Added to Event Attribute: 10

Assignment Rule for Revenue contingency

Hi Revenue contingency rule is defined for certain items. Now i need to assign a list of items to this contingency. The list of items is huge. Can anyone suggest a way other than manual entry of each item. Thanks